Posted On: April 04, 2021 Posted By: Narendra Solanki Singh

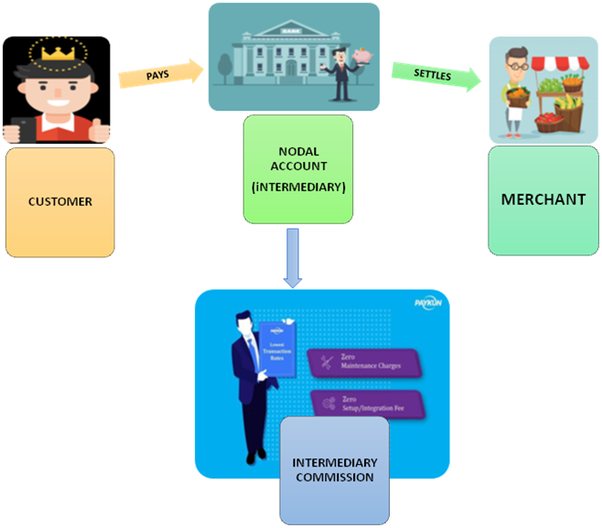

A nodal account is that account, which empowers the shippers to deal with online credit and charge payments effectively. All nodal accounts are internal accounts of the bank. They facilitate the collection of payments by intermediaries from customers. From that point, the sum gets naturally and straightforwardly moved into the shipper's business financial balance from the vendor's record.

With the new period of advanced stages and aggregators upsetting the market, the RBI has proposed nodal account represents online mediators. The reason for a nodal account is to hold assets in the interest of the clients and sellers. It shields the interests of clients and merchants so payments are gathered, handled and processed are done to applicable sellers immediately. It’s been monitored regularly and bank audits the transactions in the nodal account. There is a need to regulate the working of nodal accounts. Consequently, RBI orders a quarterly review for each nodal account. Reviews must be submitted inside 10 days of the finish of each quarter.

Numerous banks would offer the types of assistance for opening a nodal account. Mediators would have to get into a concurrence with the banks and furthermore need to satisfy the predefined terms and states of the working of the record referenced in the arrangement.

Middle people would have to satisfy certain necessities referenced priory by the banks to be qualified for opening the nodal account like the exchanges stream, business notoriety, and so forth. A nodal account guarantees that the cash doesn't lawfully have a place with the mediator anytime of time. Nodal Accounts were presented by the RBI as a command for mediators like aggregators, e-commerce platforms & payment gateways. Nodal accounts need to be audited by a third-party auditor with by the go-between. The auditor needs to be independent from the accountant that does the regular accounting for the intermediary.

Opening a current record with a similar bank is by and large requested with the arrangement of a Nodal Account. Nodal Account needn't bother with KYC as it has a place with the actual bank (inward record).

The conditional activities remember a ton of cycles for a Nodal Account. For instance — with every payee expanding, the recipient should be added thus banks would have to engage in a considerable lot of such endorsements and authorisations. These records are not kept up and worked by the middle people; they are the inner financial balances. These cycles can't be programmed as of now as all capacities are isolated and manual intercession would be required.

Presently, these delegates are out and out a different substance from the client and the shipper both. Likewise, it involves the cash that a client pays online with trust and the trader is qualified for get something very similar for the products and enterprises they would give. This cash is first depended with the delegates, so it is vital that the payment is appropriately represented and settled to the really entitled one (dealer) on schedule. Likewise, it is fundamental that the client's advantage is protected and generally speaking straightforwardness is kept up.

The mediators are needed to satisfy pre-determined necessities and be qualified for beginning this record, for example, exchange stream, business picture, and so forth it needs to come into concurrence with the bank in regards to something similar. By and large, a current record should be opened with a similar bank and the KYC should be submitted for that. There are a great deal of cycles in the activities of a nodal account, for example, with every client payee a recipient is to be added and different endorsements and approvals are to be handled for something similar. Likewise, not these capacities are computerized, a great deal of cycles should be done physically.

It can get the credits of – the payments made by the client through that mediator (as talked about prior), assets to be changed over from the ordinary record, and discounts gave by the vendor would be prepared through it. The charges can be the payment settlements to the vendor, move to another nodal account (according to prespecified arrangements), the client discounts, and the middle people commission.

Subsequently, the mediators like PayG can't pull out or take some other assets with the exception of the entitled and foreordained commission.

Through PayG Payments Bank' Nodal Account offering with amazing APIs, simpler on-boarding and devoted Key record director, the whole cycle turns out to be simple. We give an incredible, simple and powerful framework to help you centre around your business.

Your email address will not be published.

by PayG • January 23, 2023

by PayG • January 23, 2023

by PayG • September 23, 2023

by PayG • March 04, 2023

by PayG • February 04, 2023

by PayG • January 10, 2023

by PayG • Novemeber 03, 2023

by PayG • September 20, 2021

by PayG • AUGUST 14, 2021

by PayG • JUNE 30, 2021